UNION BUDGET 2020 (highlights)

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants UNION BUDGET 2020 (highlights) 6 February 2020 | budget, budget 2020, compliance, finance, Form 16, income tax, India, india union budget India’s big budget for the fiscal year 2020-2021 arrived during a time where the country is witnessing feeble economic growth and a slowdown in macro-economic activities. This scenarios is quite evident from the performance of various key sectors including real estate, infrastructure, manufacturing etc.The budget had to live up to the expectations of all groups of the society ranging from an Individual to a big corporate. The below paragraphs talk some key highlights from this budget: FOR INDIVIDUALS· Instant online allotment of PAN based on Aadhaar. · Extension of tax holiday on affordable housing by 1 year. · Additional deduction of Rs.1.5 lacs for interest paid on affordable housing loans extended until 31 Mar 2021. · Donations made to charitable institutions under 80G to be verified against annual information report filed by these institutions. · New (Optional) Tax Regime For individual taxpayers, new optional income tax regime came into picture. Under the new regime individual assesses with taxable income of less than Rs.15 lakhs slabs can avail of lower tax rates if they forego various exemptions and deductions. New optional tax slabs are rates are FOR CORPORATE Waiver of Dividend Distribution Tax A big boost for the corporate sector came in as the government decided to waive off the Dividend Distribution Tax in the hands of corporate. The dividend will now be taxed in the hands of the investors. FOR COOPERATIVES Tax on cooperative societies comes down to 22% from an earlier rate of 30%. INDIRECT TAXES Rise in customs and excise duties on furniture, footwear and cigarettes. The tax on ESOPs will be deferred by five years encouraging more issue of ESOPs. GST New simplified GST return to be implemented from Apr 1 2020. MSMEs now come under mandatory audit if they reach a turnover threshold of Rs.5 crore as against Rs.1 crore if they carry out less than 5% of their business in cash. VIVAD SE VISHWAS SCHEME The scheme is targeted to boost the collection of Direct Taxes. Government plans to waive off interest and penalty for those tax payers who pay their pending disputed taxes by March 31. Share this post: Facebook-f X-twitter Contact Categories work from home tax self-employed salary slip roc rent paid rent payslip payroll deductions payroll pay slip mca kyc job change ITR india union target India income tax return income tax hra house rent allowance freelancing freelancer Form 16 finance employee compliance budget 2020 budget allowances Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

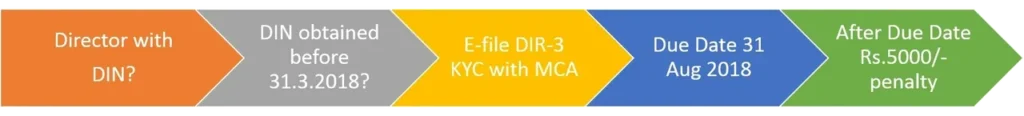

DIR-3 KYC Who should file & when

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants DIR-3 KYC Who should file & when 6 August 2018 | accounting, compliance, finance, kyc, mca, roc In its latest announcement the Ministry of Corporate Affairs (MCA) had made it mandatory to do KYC of directors annually. For complying with the same DIR-3 KYC form has been provided. Who does it apply and what needs to be done is presented in the flow-chart below: Basic Documents required for DIR-3 1. PAN Card 2. Passport size photos of directors 3. Address proof of directors 4. Photo ID proof of directors 5. Passport No. 6. Driving Licence 7.Digital Signature 8. Aadhaar card 9. Electricity/Utility/Phone bill not more than 2 months old 10. Verified email and phone no. 11. Voter id number The copies of documents need to be self-attested by the Directors and the form to be certified by a practicing professional (Chartered Accountant or Company Secretary or CMA. Need help in filing DIR-3? Call us! Share this post: Facebook-f X-twitter Contact Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

Changed job Lately?? Things to Do from income tax standpoint

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants Changed job Lately?? Things to Do from income tax standpoint 2 August 2018 | accounting, allowances, finance, Form 16, income tax, income tax return, India, ITR, job change, pay slip, payroll, payroll deductions, payslip, salary slip Switching jobs is usual. There are a lot of reasons while people change jobs. Some people change for financial gains while some change for career growth. The reasons can be plenty. Whatever is the reason, there is always an element of excitement of joining a new organization and you have new hopes and dreams with this change. To ensure that this excitement and enthusiasm continues and is not dampened by income tax issues, keep in mind the following points whenever you make a job change. 1. Make sure you always declare your income earned from previous employer to your current employer: I have come across a lot of cases where the employees changed jobs during a financial year and failed to declare the income from previous employer to the current one. The result : while filing their Income Tax Return they not only had to pay the differential tax but also had to pay interest on the tax which was not deducted by the employers. 2. Your tax slab can change when you combine the salary you have received from the different employers. 3. Provide all necessary documents to the employers so that you can claim benefit of exempted allowances, investments made, housing loan principal and interest benefit etc. 4. Don’t claim any exemptions twice: While you will submit the necessary proofs to take benefits allowable under income tax, at the same time ensure that you don’t end up taking any benefit more than once. 5. Don’t think you can hide the salary income: Your Form 26AS would reflect all the employers you have worked for and the salary they have paid to you. The same can be viewed when you logon to the income tax e-filing website: https://www.incometax.gov.in/ The income tax department too have access to this data so don’t think you can hide the salary you received during the year. My advise: next time you change a job, keep all these points in mind to ensure a smooth income tax compliance process. Still have any doubts, call us at 9999017642 Share this post: Facebook-f X-twitter Contact Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120