Limited Liability Partnership (LLP)

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants Limited Liability Partnership (LLP) 11 May 2022|accounting, Limited Liability Partnership, LLP What is a Limited Liability Partnership or LLP’s? Investors are increasingly choosing the hybrid structure known as the limited liability partnership (LLP), which combines the advantages of both a partnership and a corporation. A legal LLP agreement creates a business structure. This LLP agreement specifies who will be the designated partner and the roles assigned to each partner. LLPs are sometimes described as a hybrid of partnerships and corporations. Features of a Limited Liability Partnership (LLP): The partner’s liability is limited to the shares purchased. This corporation has no joint liability. LLPs are subject to fewer compliance requirements than other types of businesses. If compliance costs are reduced, expenses are also reduced. The individual must sign an agreement to establish this business, and no further governing documents are required. The partners in this form of business are the only owners and assume full managerial responsibility. A Limited Liability Partnership (LLP) is a good option if you want to start a new company with your partners but don’t want to deal with as many regulations. LLPs have less compliance and more liabilities than other companies. Limited Liability Partnership (LLP) Registration Process The registration procedure is as follows: • Obtain a Digital Signature Certificate • Apply a Director Identification Number (DIN) • Approval of the Name • LLP incorporation • Submit LLP Agreement 1. To register LLP, the Designated Partners must first apply for a digital signature because all documentation is uploaded online and must be signed digitally. 2. The following step is to collect the Directors Identification Numbers for all of the LLP’s directors. 3. After logging onto the MCA’s official website, two proposed LLP names may be submitted for approval, handled by the Central Registration Certificate. 4. The following documents are required for the incorporation of a Limited Liability Partnership: For Partners: Photocopies of your PAN card, proof of address, proof of residence, photo, and passport. For the LLP: Proof of address or utility bill, a photocopy of the rental agreement, and a no-objection certificate obtained from the landlord. The Benefits of a Limited Liability Partnership: Partners’ assets cannot be removed or seized to satisfy partnership debts and liabilities in an LLP. Each partner’s liability is limited. Because an LLP is a distinct legal entity, business contracts are made in the LLP’s name and do not require signatures from all partners. In an LLP, the entire operations does not dissolve upon the death, financial crisis, or resignation of another one of the partners. LLP has no minimum capital contribution requirement. It is readily registered with the minimum capital. The number of members in an LLP is unlimited, just like in a corporation. In a limited liability partnership, partners’ responsibilities are flexible. Each partner has a personal right to govern the business as part of the agreement. Dividend distribution tax (DDT) does not apply to LLP because it adheres to principles of pass-through taxation. As a result, the company is not subject to double taxation, and each partner has to pay personal taxes. Conclusion The LLP concept is a hybrid of Partnership, and it benefits both small and medium-sized businesses. Each participant is accountable for their activities. Additionally, it is referred to as an “alternative corporate business vehicle” since its activity is similar to a general partnership but has a specific provision under the limited liability rule. Facebook-f X-twitter Contact Categories work from home tax self-employed salary slip roc rent paid rent payslip payroll deductions payroll pay slip mca kyc job change ITR india union target India income tax return income tax hra house rent allowance freelancing freelancer Form 16 finance employee compliance budget 2020 budget allowances Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

Tax Planning For Individuals in India

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants Tax Planning For Individuals in India 4 April 2022|employee, house rent allowance, hra, income tax, income tax return, tax Tax planning is a legal and statutory method of minimizing one’s annual tax liabilities. It will help you make the possible use of tax deductions, exemptions, and benefits to minimize your tax burden. To reduce one’s tax burden, one must engage in tax planning. The government provides various tax-saving opportunities. Legal tax planning aims to minimize a taxpayer’s tax burden. Benefits of Tax Planning for Individuals: The following are the primary benefits of tax planning: Tax preparation enables the financial planning process to run smoothly. Tax compliance minimizes legal entanglements Tax planning enables the allocation of taxable income to various investment vehicles. Effective tax planning enables you to save money. Companies can contribute to our country’s economic growth through tax planning. Contributes to economic stability Preferred Tax-Saving Strategies: To minimize your taxable income, make a Rs 1.5 lakh investment under Sec 80C. Further deductions of Rs 50,000 can also be claimed under 80CCD by contributing to NPS (1b). Section 80D permits you to a tax deduction of up to Rs. 100,000 if you get medical insurance. If you are a senior citizen, you and your family can deduct up to Rs. 50,000 from your taxes under this section. Deduct up to Rs 50,000 in interest on home loans under Section 80EE. Additional Tax Savings Options: Fifty thousand rupees for medical insurance premium. (Rs 25000 for self, spouse, and children; Rs 25000 for dependent parents under the age of 60). Medical insurance premiums for senior citizens are eligible for benefits up to Rs 1,00,000 each year. Section 24 allows a deduction for interest charged on a house loan up to Rs 2 lakhs. A home loan might also help you save on taxes because the principal amount of the loan is claimed u/s 80C up to Rs. 1.5 lakh, and also, the amount of the interest is deductible as income from housing property. Any charitable contribution to registered institutions or funds may be deductible under section 80G. Interest on educational loans is deductible under section 80E. Make A Strategy For Your Tax-Saving Investments: Tax-saving investments are best planned at the start of the financial year. Plan your tax savings for the year with these tips: Review your existing tax-saving expenses, such as insurance payments, children’s tuition fees, EPF contributions, and home loan repayment. Subtract this from Rs 1.5 lakh to calculate investment. You are not required to invest the entire amount if expenditures exceed the limit. Tax-saving investments should match your risk level. Popular options include ELSS, PPF, NPS, and fixed deposits. House Rental Allowance: Paying rent is a common way to save income tax. HRA exemption is available to individuals who reside in rented housing (Section 10 (13A) of Income Tax, 1961). You may be entitled to a tax deduction if you match the following criteria: The total amount of HRA received Rent paid lowered by 10% of basic salary 40% of the base salary for non-metro taxpayers and 50% for metro taxpayers Conclusion: It is best to pay taxes regularly. Tax-saving investments assist reduce income taxes and also create wealth over time. In addition, corporate tax planning helps manage expenses, allocate capital budgets, and reduce sales and marketing costs. Facebook-f X-twitter Contact Categories work from home tax self-employed salary slip roc rent paid rent payslip payroll deductions payroll pay slip mca kyc job change ITR india union target India income tax return income tax hra house rent allowance freelancing freelancer Form 16 finance employee compliance budget 2020 budget allowances Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

UNION BUDGET 2021 (highlights)

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants UNION BUDGET 2021 (highlights) 24 February 2021|budget, income tax, India, india union budget Presentation of the first digital budget announcement, Union Finance and Corporate Affairs Minister Smt. Nirmala Sitharaman suggested that the Union Budget 2021-2022, inspired by the Covid-19 pandemic, is touted as the best budget in 100 years. This budget has set the benchmark for India to become Aatmanirbhar or self-reliant. Rs. 34.5 Lakh, Crore estimate for 2021-22, is announced by the finance minister in the pandemic context. This 2021-22 budget called for the maximum capital growth of 34.4%, providing railways, roads and defense with more funding. 6 Union Budget Pillars for 2021-22: Health and Well-being Infrastructure and physical & financial resources Aspiration India Inclusive Development Human Capital Reinvigorating R&D and innovation Minimal government and maximum governance Important Announcements: Healthcare and Well-Being – The budget for the health and wellness sectors allocated to Rs. 2,83,000 Crores The action plan required nearly 30,000 rural and urban health and wellness facilities to be set up. For the Covid-19 vaccine, the finance minister also funded around Rs. 35,000 Crores with a plan to provide additional funds. Models of Growth & Investment – The finance minister emphasized the government’s commitment to building an expansionary budget for ‘Aatmanirbhar Bharat’ to enhance capital investment, growing spending and promoting better employment opportunities. Major Infrastructural Announcements – Public-Private mode of collaboration in major ports More Government Infrastructure Pipeline projects Public transportation budget of around Rs. 18,000 Crores Development of Metrolite and associated technologies in Tier 2 cities Approximately Rs. 1, 00,000 crores for the construction of 11,000 kilometers of the national highway corridor In The Manufacturing Sector – Establishment of 7 mega parks for textiles Production-Linked incentive program or PLI for a wide range of products in electronics that seeks to make India a worldwide manufacturing and export hub At about Rs. 5.54 Lakh Crores, the government’s capital expenditure for FY22 is very generous, which is 35 percent higher than last year. Investments Announcements – The FDI growth in the insurance company from the current 49% to 74% Public banks recapitalization of approximately Rs. 20,000 Crores was proposed for FY22 The establishment of the Development Finance Organization Balancing the Books and The Budget Deficit – The country’s fiscal deficit is forecast at 9.5% of GDP for FY21, i.e., during April 2020 and March 2021, at the macro level. The finance minister projects a fiscal deficit of 6.8 % for FY22, with a projection to reduce it consistently to below 4.5 percent by 2025-26. Proposed strategy to Handle The FY22 Fiscal Deficit: A total of Rs. 12,00,000 Crores Borrowing Strategic divestment of two banks of the public sector and one general insurance company LIC’s Initial Public Offering (IPO) Sale of BPCL and Air India Selling non-core properties such as surplus land Taxes: There are no significant changes in direct taxation. This budget aimed to improve the tax experience through: Extending the framework of Vivad se Vishwas until 28 Feb 2021 Reduction in the re-opening of tax assessments from 6 to 3 years Reduced litigation involving small taxpayers Increase thresholds for a tax audit. Share this post: Facebook-f X-twitter Contact Categories work from home tax self-employed salary slip roc rent paid rent payslip payroll deductions payroll pay slip mca kyc job change ITR india union target India income tax return income tax hra house rent allowance freelancing freelancer Form 16 finance employee compliance budget 2020 budget allowances Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

UNION BUDGET 2020 (highlights)

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants UNION BUDGET 2020 (highlights) 6 February 2020 | budget, budget 2020, compliance, finance, Form 16, income tax, India, india union budget India’s big budget for the fiscal year 2020-2021 arrived during a time where the country is witnessing feeble economic growth and a slowdown in macro-economic activities. This scenarios is quite evident from the performance of various key sectors including real estate, infrastructure, manufacturing etc.The budget had to live up to the expectations of all groups of the society ranging from an Individual to a big corporate. The below paragraphs talk some key highlights from this budget: FOR INDIVIDUALS· Instant online allotment of PAN based on Aadhaar. · Extension of tax holiday on affordable housing by 1 year. · Additional deduction of Rs.1.5 lacs for interest paid on affordable housing loans extended until 31 Mar 2021. · Donations made to charitable institutions under 80G to be verified against annual information report filed by these institutions. · New (Optional) Tax Regime For individual taxpayers, new optional income tax regime came into picture. Under the new regime individual assesses with taxable income of less than Rs.15 lakhs slabs can avail of lower tax rates if they forego various exemptions and deductions. New optional tax slabs are rates are FOR CORPORATE Waiver of Dividend Distribution Tax A big boost for the corporate sector came in as the government decided to waive off the Dividend Distribution Tax in the hands of corporate. The dividend will now be taxed in the hands of the investors. FOR COOPERATIVES Tax on cooperative societies comes down to 22% from an earlier rate of 30%. INDIRECT TAXES Rise in customs and excise duties on furniture, footwear and cigarettes. The tax on ESOPs will be deferred by five years encouraging more issue of ESOPs. GST New simplified GST return to be implemented from Apr 1 2020. MSMEs now come under mandatory audit if they reach a turnover threshold of Rs.5 crore as against Rs.1 crore if they carry out less than 5% of their business in cash. VIVAD SE VISHWAS SCHEME The scheme is targeted to boost the collection of Direct Taxes. Government plans to waive off interest and penalty for those tax payers who pay their pending disputed taxes by March 31. Share this post: Facebook-f X-twitter Contact Categories work from home tax self-employed salary slip roc rent paid rent payslip payroll deductions payroll pay slip mca kyc job change ITR india union target India income tax return income tax hra house rent allowance freelancing freelancer Form 16 finance employee compliance budget 2020 budget allowances Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

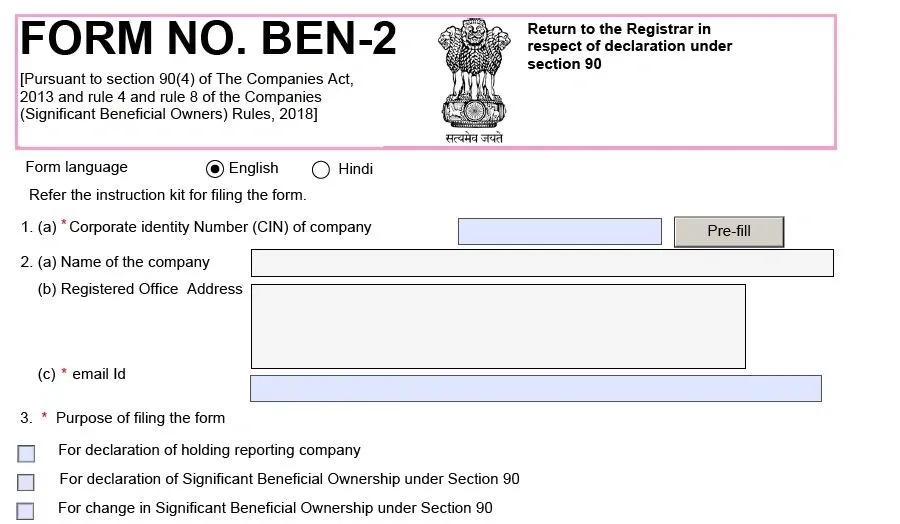

Amendment of Significant Beneficial Owner Rules

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants Amendment of Significant Beneficial Owner Rules 14 January 2020 | compliance, India, mca The 2013 Corporate Act has brought a new revolution by lifting the Corporate Veil concept with an aim to safeguard the investor interests in every possible way. In addition to the prevailing stringent norms with regard to related party transactions, the MCA has taken a step further and mandated all companies under its administration to disclose as a part of their routine regulatory filings, the significant beneficial owners in form BEN-2 to the Registrar of Companies in their respective jurisdictions. This notification which is largely based on the recommendations of Financial Action Task Force, an inter-governmental organization is also seen as a move against money laundering and terror financing through complex structured transactions. Who is a significant beneficial owner (SBO)? An individual, acting alone or together with others (including trusts and persons resident outside India), who beneficial interests of not less than 10% in the shares of the relevant company or holds the right to exercise significant influence over the firm. The Act has defined beneficial interest pervasively as the direct or indirect right of a person exercised through contract or otherwise upon shares or to receive or participate in any dividends or other distribution in respect of the shares. The SBOs are required to make a declaration to the companies expressing their status in BEN-1, upon the receipt of which companies shall file such particulars with ROC in BEN-2. Subsequently, a unique number gets allocated to each SBO. It is noteworthy to mention here that the SEBI has also now issued separate circular directing the listed companies to file the disclosure of SBOs as a part of the quarterly disclosure of shareholdings to stock exchanges. The penalty for non- compliance shall fall on the reporting company and every officer in default for a fine amount not less than ₹10 lakhs which may extend up to ₹50 lakhs and in case of continuing default a fine of ₹1000 per day. Currently the Companies Regulator has permitted companies to furnish this information by March 31, 2020. Share this post: Facebook-f X-twitter Contact Categories work from home tax self-employed salary slip roc rent paid rent payslip payroll deductions payroll pay slip mca kyc job change ITR india union target India income tax return income tax hra house rent allowance freelancing freelancer Form 16 finance employee compliance budget 2020 budget allowances Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

The Freelancing World

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants The Freelancing World 17 September 2018 | freelancer, freelancing, self-employed, work from home All of us dream of getting out of the mundane 9am-5pm office routine and do something of our own. While the thought of working as a freelancer seems very exciting, it comes with its own set of challenges and hiccups. Through this article, I have tried to share some tips together with my thoughts and experiences of working as a freelancer over the past couple of years. Hope you will find the information useful. Which are some good Freelancing Websites? There are a lot of websites which are used by the freelancers across the globe and at times it becomes very difficult to distinguish between the good and the better ones. Based on my experience, I found the following websites to be better than the rest: https://www.freelancer.com https://www.upwork.com/ https://www.guru.com http://worknhire.com https://www.peopleperhour.com DO’s of Freelancing Websites? These are the points you should definitely keep in mind when you are trying to find work on these freelancing websites: 1. Create a good profile. This is the page an employer would look at when hiring you for the first time. Make it as detailed as possible as good as your RESUME 🙂 2. Don’t forget to mention your core skills 3. Keep searching and bidding on the jobs you find relevant. Don’t get disheartened if you dont find the relevant job. Keep trying and don’t loose hope! 4. Keep your charges reasonable. Don’t keep it too low neither too high. Both are deterrents for employers. 5. Under promise and over deliver is the key. Give your 100% even if it is a small task. Ratings you get from your employers are the most crucial part of working as a freelancer. Good ratings would always help you get more work. 6. Divide your tasks into multiple steps and fix the pricing for different steps: This will ensure two things: the employer will get the confidence that you are organized and know your job well. At your end, you can be assured that the fees you are supposed to receive are secured. On most of these websites, you can ask the customer needs needs to release the payment as soon as one step is done so you can move onto the next one. If the customer releases it, good move on to the next step else you can put the project on hold. DONT’s of Freelancing Websites The following points are word of caution which you should be aware of when working on these freelancing websites: 1. Beware of Fake clients – There are genuine and fake clients on most freelancing websites. As a freelancer you can check the employers’ profile if they have employed other freelancers earlier. In case the employer is new to the website, you need to rely on your judgement and gut. There are other ways too to distinguish between a genuine and fake client like the budget he is offering for the task is way too high etc. 2. Prefer to communicate on the portal itself: Most of these freelancing websites are equipped with audio, video and messaging tools to enable you to communicate with the employer. Always insist the employer to communicate through the portal. 3. DO NOT take payments outside the portal:This one is a strict NO-NO and can result in permanent suspension of your account from the portal. All the payments should happen through the portal only. The above information might be a bit over whelming but if you still have any questions/queries or need any advise, just reach out to us and we will be able to guide you. Share this post: Facebook-f X-twitter Contact Categories work from home tax self-employed salary slip roc rent paid rent payslip payroll deductions payroll pay slip mca kyc job change ITR india union target India income tax return income tax hra house rent allowance freelancing freelancer Form 16 finance employee compliance budget 2020 budget allowances Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

Paying Rent but not getting HRA?

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants Paying Rent but not getting HRA? 10 August 2018 | allowances, employee, house rent allowance, hra, income tax, income tax return, ITR, payroll, payslip, rent, rent paid, salary slip, self-employed Are you A self-employed businessman or professional or a salaried employee? Staying in a rented accommodation and paying rent? You or your spouse don’t own a residential accommodation at the place where you reside or are working and are also paying rent? Not receiving any House Rent Allowance or HRA ? Can you still take any benefit on the rent paid? The answer is Which section allows you to claim exemption? As per the provisions of the Income Tax Act, 1961, you can still claim benefit of rent paid under section 80GG. What is the limit for exemption? The section allows an individual to claim exemption as the minimum of: – Rs. 5000 per month – 25% of Total Income – Actual Rent paid less 10% of Total Income What you need to do? Just fill Form 10BA with all the details related to payment of rent and you are good to claim the exemption. Still have any confusion/concerns? Reach out to us and we will be happy to help! Share this post: Facebook-f X-twitter Contact Categories work from home tax self-employed salary slip roc rent paid rent payslip payroll deductions payroll pay slip mca kyc job change ITR india union target India income tax return income tax hra house rent allowance freelancing freelancer Form 16 finance employee compliance budget 2020 budget allowances Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

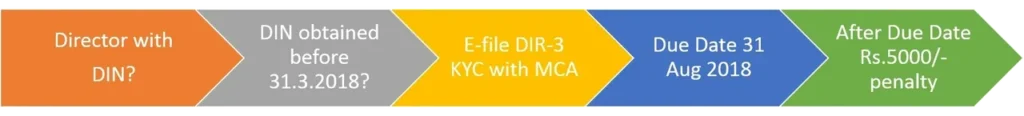

DIR-3 KYC Who should file & when

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants DIR-3 KYC Who should file & when 6 August 2018 | accounting, compliance, finance, kyc, mca, roc In its latest announcement the Ministry of Corporate Affairs (MCA) had made it mandatory to do KYC of directors annually. For complying with the same DIR-3 KYC form has been provided. Who does it apply and what needs to be done is presented in the flow-chart below: Basic Documents required for DIR-3 1. PAN Card 2. Passport size photos of directors 3. Address proof of directors 4. Photo ID proof of directors 5. Passport No. 6. Driving Licence 7.Digital Signature 8. Aadhaar card 9. Electricity/Utility/Phone bill not more than 2 months old 10. Verified email and phone no. 11. Voter id number The copies of documents need to be self-attested by the Directors and the form to be certified by a practicing professional (Chartered Accountant or Company Secretary or CMA. Need help in filing DIR-3? Call us! Share this post: Facebook-f X-twitter Contact Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120

Changed job Lately?? Things to Do from income tax standpoint

HOME SERVICES FEEDBACK CONTACT US BLOG X Deepti Arora & Co. – Chartered Accountants Changed job Lately?? Things to Do from income tax standpoint 2 August 2018 | accounting, allowances, finance, Form 16, income tax, income tax return, India, ITR, job change, pay slip, payroll, payroll deductions, payslip, salary slip Switching jobs is usual. There are a lot of reasons while people change jobs. Some people change for financial gains while some change for career growth. The reasons can be plenty. Whatever is the reason, there is always an element of excitement of joining a new organization and you have new hopes and dreams with this change. To ensure that this excitement and enthusiasm continues and is not dampened by income tax issues, keep in mind the following points whenever you make a job change. 1. Make sure you always declare your income earned from previous employer to your current employer: I have come across a lot of cases where the employees changed jobs during a financial year and failed to declare the income from previous employer to the current one. The result : while filing their Income Tax Return they not only had to pay the differential tax but also had to pay interest on the tax which was not deducted by the employers. 2. Your tax slab can change when you combine the salary you have received from the different employers. 3. Provide all necessary documents to the employers so that you can claim benefit of exempted allowances, investments made, housing loan principal and interest benefit etc. 4. Don’t claim any exemptions twice: While you will submit the necessary proofs to take benefits allowable under income tax, at the same time ensure that you don’t end up taking any benefit more than once. 5. Don’t think you can hide the salary income: Your Form 26AS would reflect all the employers you have worked for and the salary they have paid to you. The same can be viewed when you logon to the income tax e-filing website: https://www.incometax.gov.in/ The income tax department too have access to this data so don’t think you can hide the salary you received during the year. My advise: next time you change a job, keep all these points in mind to ensure a smooth income tax compliance process. Still have any doubts, call us at 9999017642 Share this post: Facebook-f X-twitter Contact Deepti Arora & Co. – Chartered Accountants Address 811, SIDCO ARAVALI APARTMENTS, GH-1,SECTOR 1, IMT MANESAR, GURUGRAM 122051 Contact Us +91 9999017642 +91 7827261120